Demystifying Crossed Cheque: All You Need To Know

A crossed cheque is a powerful tool in the realm of banking, ensuring secure transactions and peace of mind for both payers and payees. By simply drawing two parallel lines across the face of the cheque, the issuer signals that the funds are to be paid directly into the bank account of the recipient. This precautionary measure helps prevent unauthorized persons from cashing or depositing the cheque. In this article, we delve into the nuances of crossed cheques, shedding light on their significance and how to make the most of this safeguard.

The Power of Crossed Cheque: Understanding and Safeguarding Your Finances

Imagine this – you’re at the bank, ready to deposit a cheque you received as payment for your hard work. As the bank teller examines the cheque, you notice something interesting – two parallel lines running across its face. What does this mean? Welcome to the world of crossed cheques, a simple yet powerful financial tool that can help protect your money and ensure secure transactions.

What is a Crossed Cheque?

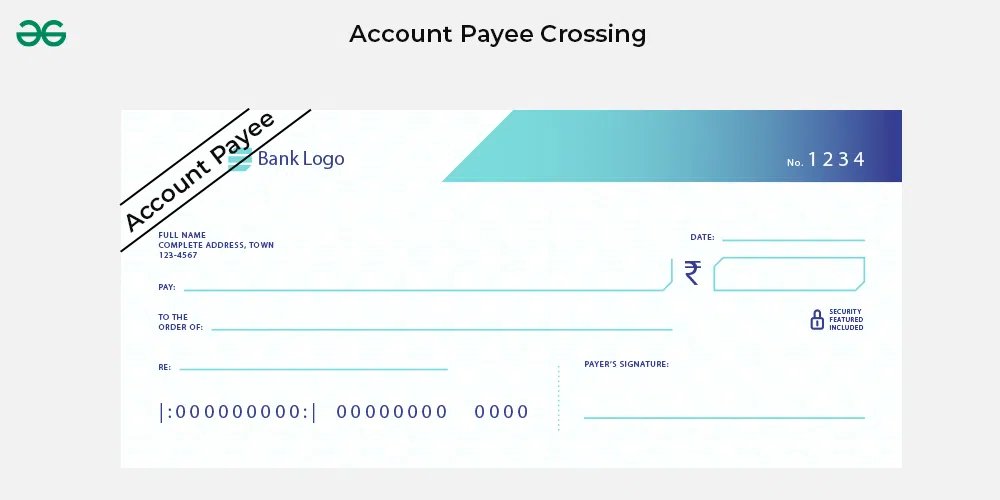

A crossed cheque is a type of cheque where two parallel lines are drawn across the face of the cheque. These lines indicate that the cheque can only be deposited directly into a bank account and cannot be encashed over the counter. In simple terms, crossing a cheque adds a layer of security by ensuring that the funds are deposited into the intended recipient’s bank account.

Types of Crossing

There are two main types of crossing – general crossing and special crossing.

General Crossing

When a cheque is crossed generally, it means that the cheque can only be deposited into a bank account. The words “Account Payee” or “A/C Payee” are often written between the two lines to further specify that the funds should be credited to the account of the payee mentioned on the cheque. This type of crossing is the most common and provides a basic level of security for the cheque issuer.

Special Crossing

Special crossing involves adding the name of a specific bank between the parallel lines. This specifies that the cheque can only be deposited into an account held at that particular bank. Special crossing is useful in situations where the payee has accounts at different banks and wishes to restrict the deposit to a specific bank.

Benefits of Crossed Cheques

Crossed cheques offer several advantages, both for the issuer and the recipient.

Security

One of the primary benefits of crossed cheques is enhanced security. By restricting the encashment of the cheque, crossed cheques reduce the risk of fraud and unauthorized use. This makes them a preferred choice for high-value transactions where security is paramount.

Trackability

Crossed cheques provide a clear record of the transaction, as the funds are directly deposited into the payee’s bank account. This makes it easier to track payments and ensures transparency in financial transactions.

Prevention of Misuse

Since crossed cheques can only be deposited into a bank account, they help prevent misuse of the funds by ensuring that the money reaches the intended recipient. This added layer of control can be particularly beneficial in business transactions and payments to third parties.

How to Deposit a Crossed Cheque

Depositing a crossed cheque is a straightforward process that requires a few simple steps.

Step 1: Endorse the Cheque

Before depositing a crossed cheque, ensure that you endorse the back of the cheque with your signature. This establishes your authorization to deposit the funds into your account.

Step 2: Visit Your Bank

Take the crossed cheque to your bank and approach the teller or use the self-service deposit machines available. Fill out the deposit slip with the required information and submit the cheque for processing.

Step 3: Verification and Processing

The bank will verify the details on the cheque and process the deposit into your account. Once the funds are cleared, they will be available for your use.

Protecting Your Finances with Crossed Cheques

Crossed cheques are a valuable tool for safeguarding your finances and ensuring secure transactions. By understanding how crossed cheques work and the benefits they offer, you can protect yourself from fraud and unauthorized use of your funds. Next time you receive a crossed cheque, remember the power it holds in keeping your money safe and transactions secure.

In conclusion, crossed cheques are a simple yet effective way to enhance the security of your financial transactions. By utilizing crossed cheques, you can protect your money, track payments, and prevent misuse of funds. Remember, when it comes to financial security, crossed cheques are your trusted ally.

Crossed Cheques Explained #LITmoments – E01

Frequently Asked Questions

What is a crossed cheque?

A crossed cheque is a type of cheque where two parallel lines are drawn across the top-left corner. This signifies that the cheque can only be deposited directly into a bank account and cannot be encashed at the counter. It helps prevent unauthorized individuals from cashing the cheque.

How does crossing a cheque enhance security?

Crossing a cheque enhances security by making it more difficult for unauthorized individuals to cash the cheque. When a cheque is crossed, it can only be deposited into the account of the payee, reducing the risk of it being fraudulently endorsed and cashed by someone else.

Can a crossed cheque be converted into cash at a bank counter?

No, a crossed cheque cannot be converted into cash at a bank counter. It can only be deposited into the bank account of the payee. If the payee wants to access the funds as cash, they will need to deposit the cheque into their account and then withdraw the cash through the normal withdrawal process.

Final Thoughts

In conclusion, a crossed cheque provides an added layer of security by ensuring that the funds are deposited directly into the bank account of the payee. This type of cheque helps prevent fraud and unauthorized individuals from cashing the cheque. By crossing the cheque, the payer can have peace of mind knowing that the funds will reach the intended recipient safely. Using crossed cheques can be a simple yet effective way to protect your financial transactions.